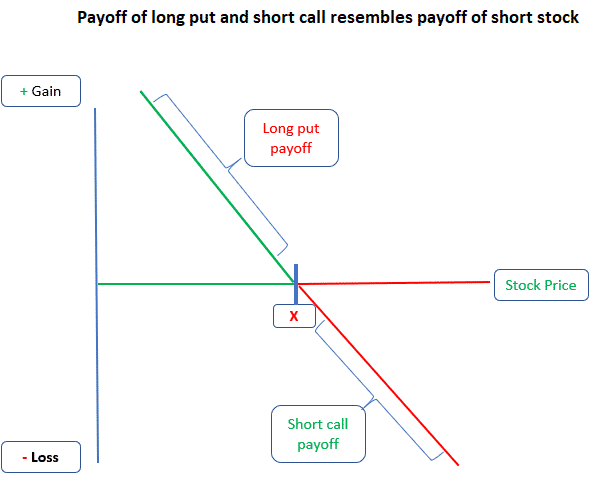

38 short call payoff diagram

Short Strangle Strategy: Ultimate Guide For 2021 Oct 28, 2020 · Short strangles have a payoff diagram shown with a dashed line in the graph of the SPY trade. The trade has high gamma, particularly when it approaches expiration. The ideal scenario for short strangles is when the price of the underlying stock trades in a narrow range between the breakeven points with decreasing volatility. Read an Option Profit & Loss Payoff Diagram | Option Alpha What this P and L diagram shows you is that with a short call option, your profit is limited to the credit that you received. ... This is what this payoff diagram looks like for a long call option. Probably should have started with this one, but it's okay. I want to challenge you guys a little bit and hopefully get you a little bit faster into ...

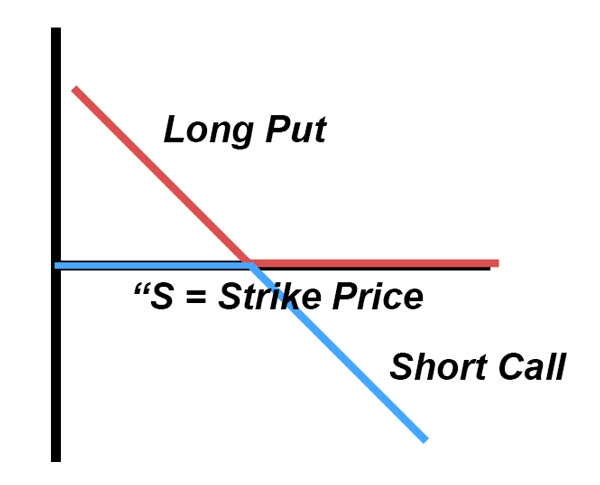

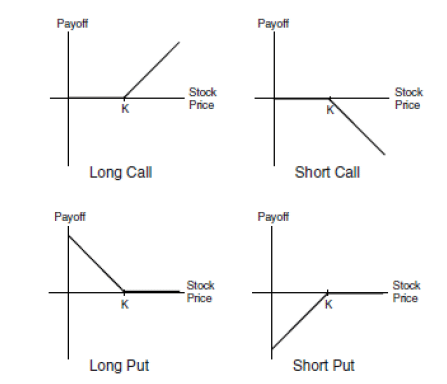

Solved A21: The payoff diagram of a protective put ... Transcribed image text: A21: The payoff diagram of a protective put resembles a (A) long call (B) long put (D) short put (E) long straddle (C) short call A22: The maximum profit from a bearish spread using 2 puts options where the put premium are pl and p2 respectively and where the strike price of put option 1 is lower than the strike price of put option 2: X1

Short call payoff diagram

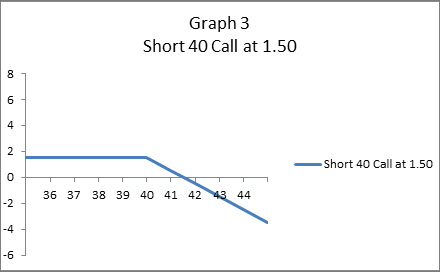

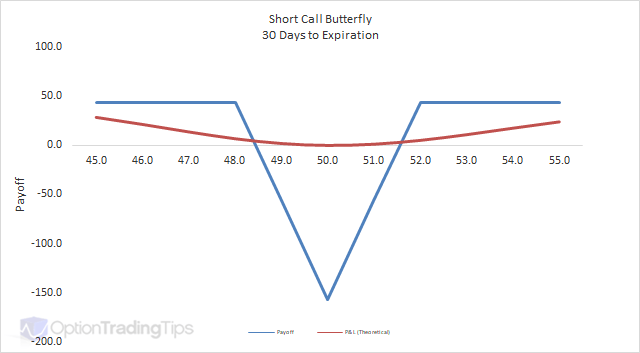

Short Condor Explained | Online Option Trading Guide Max Profit Achieved When Price of Underlying = Strike Price of Lower Strike Short Call OR Price of Underlying >= Strike Price of Higher Strike Short Call. Short Condor Payoff Diagram. 0.00% Commissions Option Trading! Trade options FREE For 60 Days when you Open a New OptionsHouse Account. Options Payoffs and Profits (Calculations ... - AnalystPrep The payoff for a call buyer at expiration date T is given by max(0,ST -X) m a x ( 0, S T - X) while the payoff for a call seller is −max(0,ST -X) − m a x ( 0, S T - X). Where: ST S T is the price of the underlying at expiration; and X is the exercise price. Call Option Profit-Loss Diagrams - Fidelity Above 41.50, or to its right on the diagram, the long call earns a profit. Note that the diagram is drawn on a per-share basis and commissions are not included. Graphing a short call. Now for the third example—a short call. Graph 3 shows the profit and loss of selling a call with a strike price of 40 for $1.50 per share, or in Wall Street ...

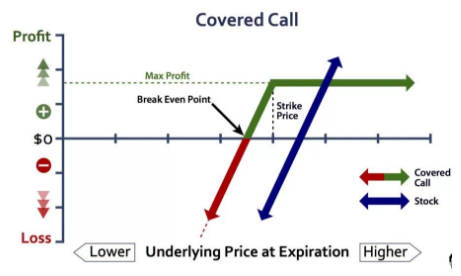

Short call payoff diagram. Short Call Definition - investopedia.com A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. It usually reflects a bearish outlook: an assumption that the price of ... Call payoff diagram | Finance & Capital Markets | Khan ... Call Payoff Diagram. Created by Sal Khan.Watch the next lesson: ... Short Call Payoff Diagram and Formula - Macroption The payoff diagram of a short call position is the inverse of long call diagram, as you are taking the other side of the trade. Basically, you multiply the profit or loss by -1. For detailed explanation of the logic behind individual sections of the graph, see long call option payoff. Short Call Payoff Formulas Covered Call Strategy: Generating Income with Options ... Moreover, it's covered in the sense that if a call option goes ITM, if a seller owns the underlying instrument, he will not lose money being short the option. The losses from the option are netted out by owning the underlying shares. As a result, this is how a call option payoff diagram appears: Covered call payoff diagram (Source ...

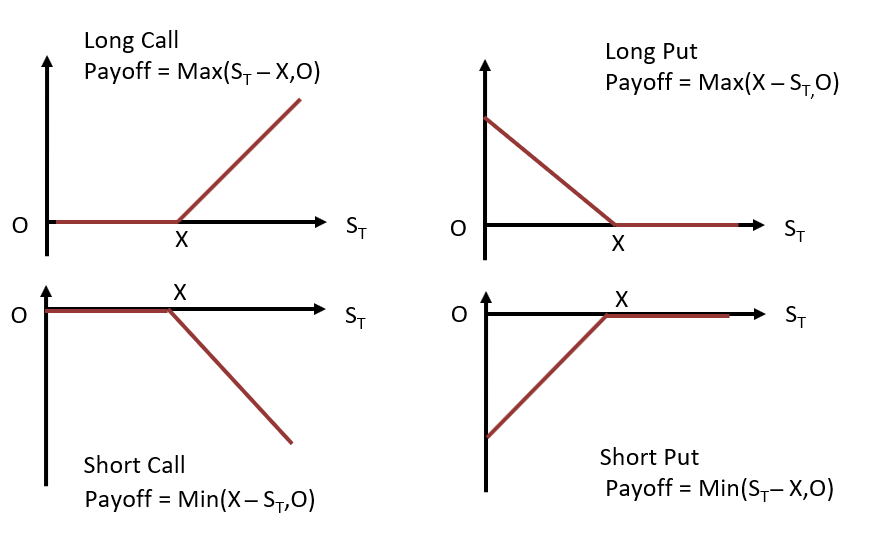

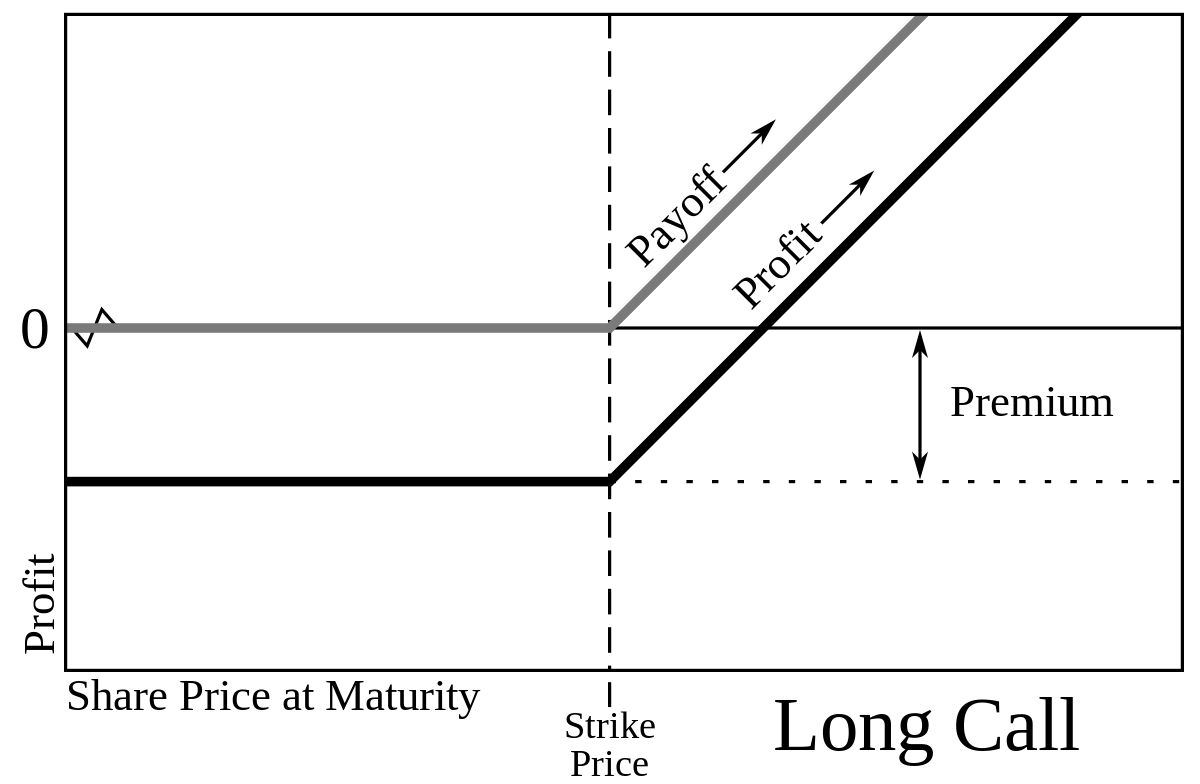

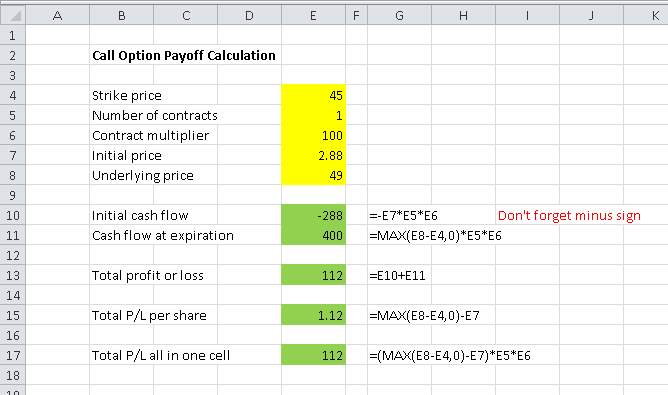

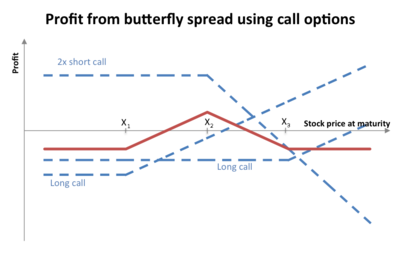

Call Option Payoff Diagram, Formula and Logic - Macroption Call Option Payoff Diagram. Buying a call option is the simplest of option trades. A call option gives you the right, but not obligation, to buy the underlying security at the given strike price. Therefore a call option's intrinsic value or payoff at expiration depends on where the underlying price is relative to the call option's strike price. Call & Put Option Profits and Payoffs | CFA Level 1 ... That is, buying or selling a single call or put option and holding it to expiration. The value, profit and breakeven at expiration can be determined formulaically for long and short calls and long and short puts. The notation used is as follows: c 0, c T = price of the call option at time 0 and T; p 0, p T = price of the put option at time 0 and T Payoff Diagram for one long &one short position in Call ... 1) Portfolio 1 break-even. Draw the gross and net payoff diagrams for a portfolio which is constructed from buying one call option with a strike price $45.00 and selling one call option with a strike price of $50. The cost of the first option of $7.75 and the cost of the second option is $3.50. Butterfly (options) - Wikipedia Long butterfly. A long butterfly position will make profit if the future volatility is lower than the implied volatility.. A long butterfly options strategy consists of the following options: . Long 1 call with a strike price of (X − a); Short 2 calls with a strike price of X; Long 1 call with a strike price of (X + a) where X = the spot price (i.e. current market price of underlying) and a > 0.

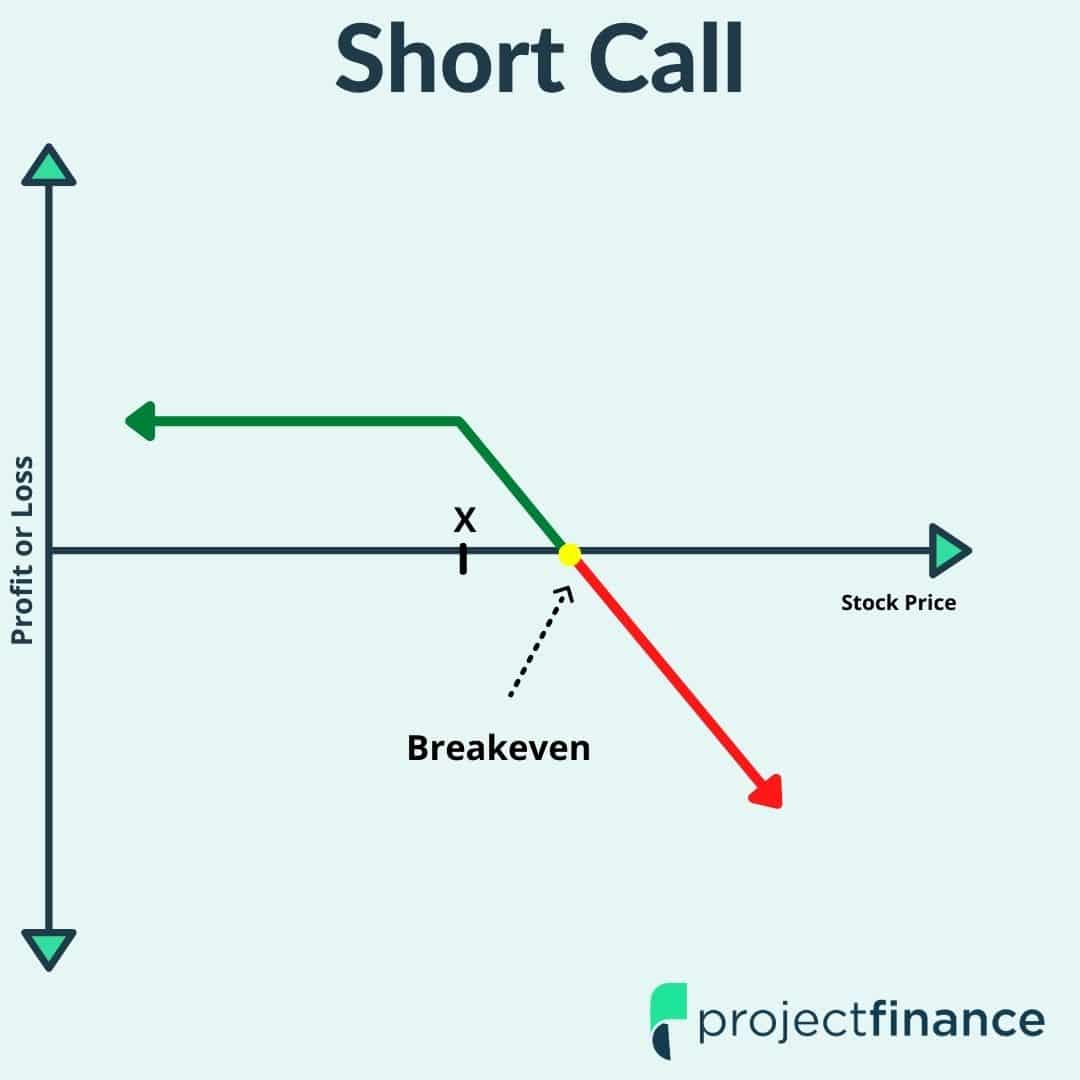

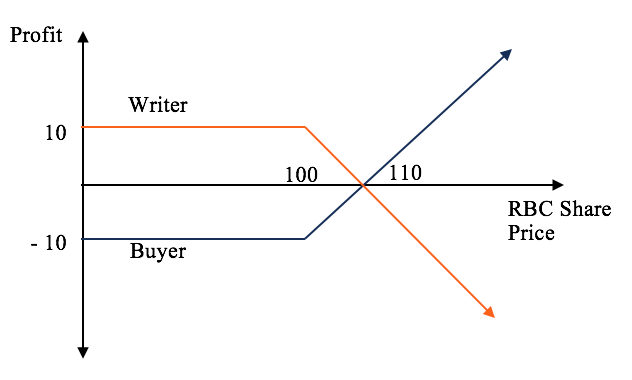

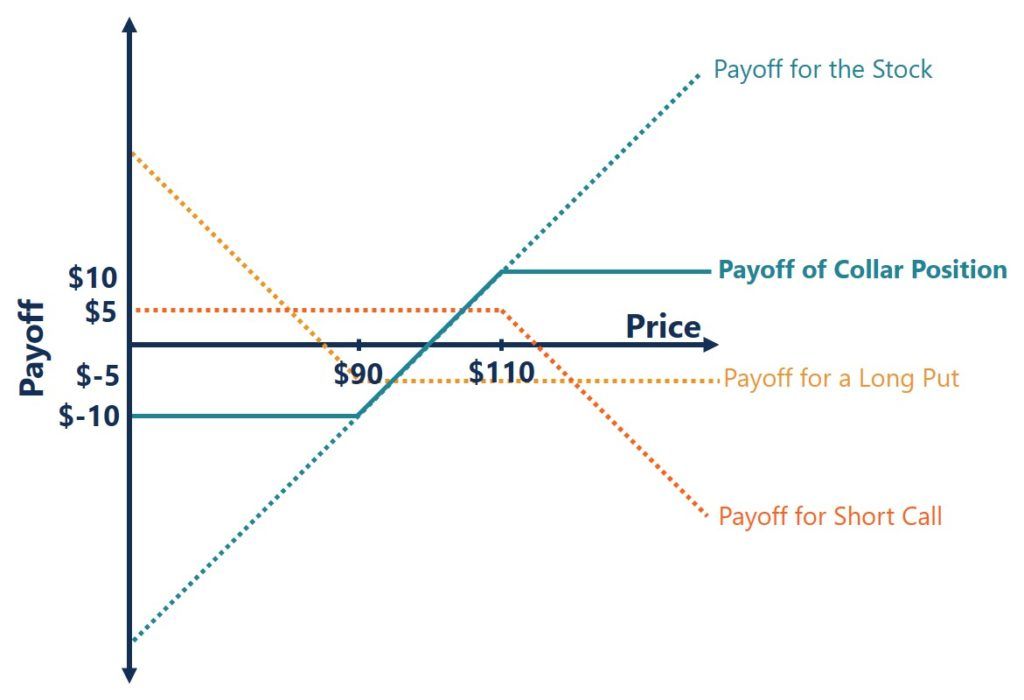

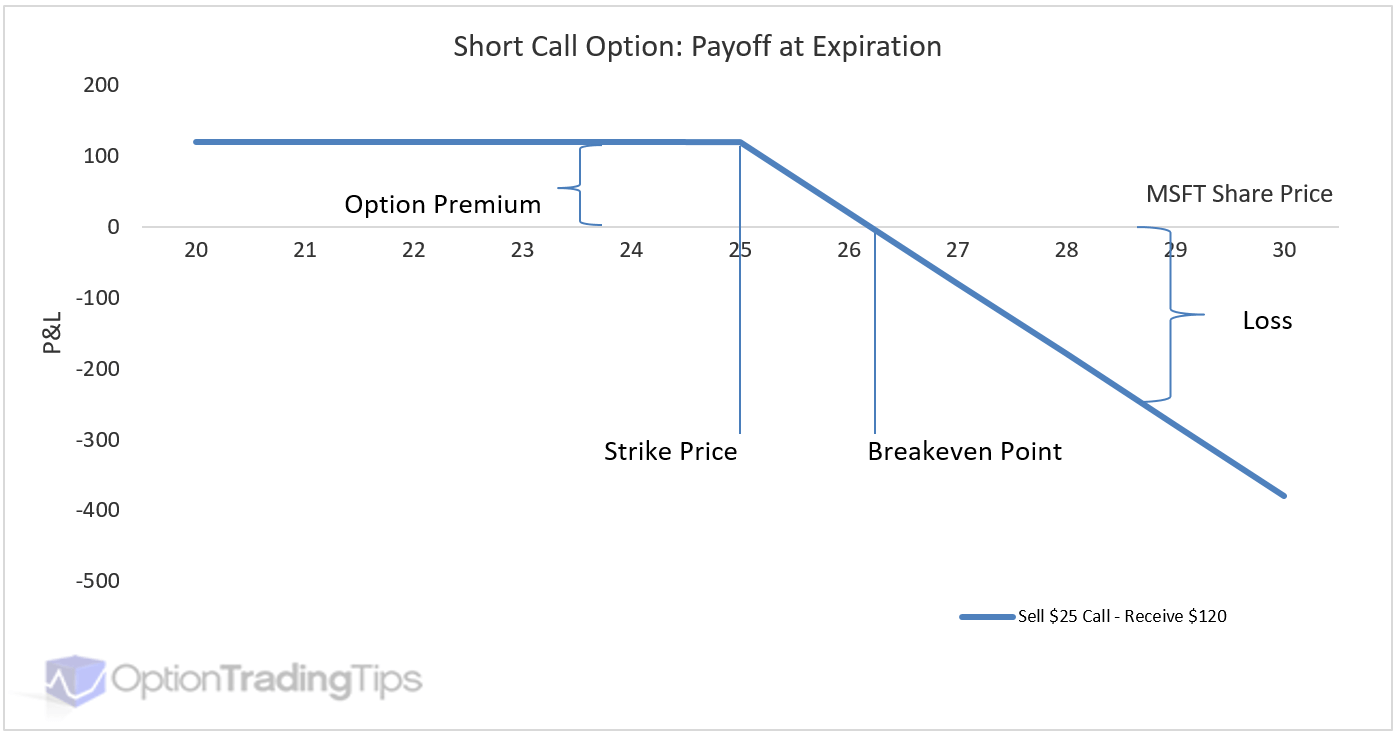

Short Call (Naked Call) Option Strategy Explained Short Call (or Naked Call) strategy involves the selling of the Call Options (or writing call option). In this strategy, a trader is Very Bearish in his market view and expects the price of the underlying asset to go down in near future. ... Your pay-off diagram is much superior to the ones usually available.I suggest if a relevant price chart ... Short Straddle - Fidelity Net credit =. 6.50. A short straddle consists of one short call and one short put. Both options have the same underlying stock, the same strike price and the same expiration date. A short straddle is established for a net credit (or net receipt) and profits if the underlying stock trades in a narrow range between the break-even points. Options Collar Guide [Setup, Entry, Adjustments, Exit] Collar Payoff Diagram The collar strategy payoff diagram has a defined maximum profit and loss. Shares of the underlying asset may be sold at the short call strike price or the long put strike price if the option is in-the-money at expiration. If the stock is between the two levels at expiration, both the call and put options will expire worthless. Short Call Strategy Guide [Setup, Entry, Adjustments, Exit] Short Call Payoff Diagram The payoff diagram for a short call represents the risk involved with selling naked options. Profit potential is limited to the amount of credit received when the call is sold. However, the risk is unlimited if the underlying asset experiences an increase in price.

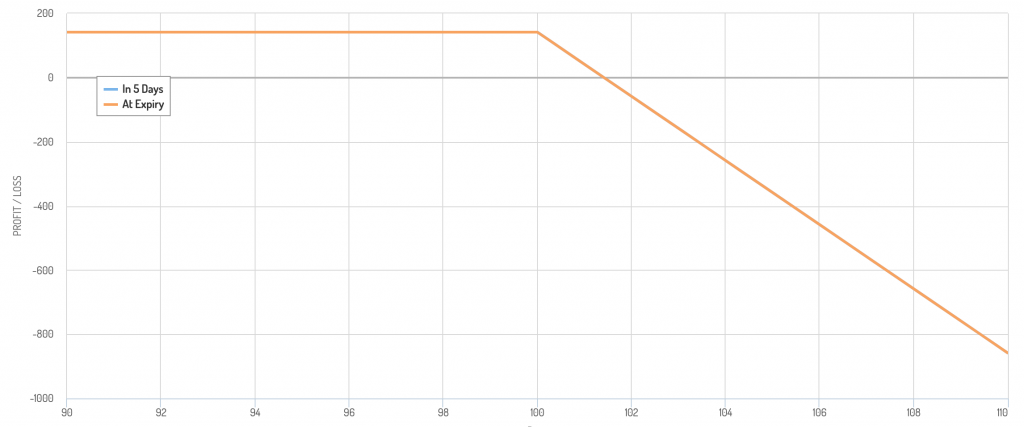

Short Call Option Payoff Graph - Options Trading IQ What we are looking at here is the payoff graph for a short call option strategy. In this example the trader has sold a 345 strike call for $4 per contract (or $400 for a standard option contract representing 100 shares). The premium collected of $400 is the most the trade can profit. That occurs at an underlying stock price of $345 and below.

Short Call Options Strategy (Awesome Guide w/ Examples) Payoff Diagram. Short calls have a similar shaped payoff diagram to a long put. Profits are flat below the strike price with a breakeven price equal to the strike price plus the premium. Above the breakeven price, losses accrue on a one to one basis with a move higher in the stock price.

Short Put Payoff Diagram and Formula - Macroption Short Put Payoff Diagram. A short put option position is a bullish strategy with limited upside and limited (but usually very high) risk. The position is initiated by selling a put option with the intention to buy it back later at a lower price or waiting until expiration and hoping it …

Iron Butterfly Options Strategy Guide - Option Alpha Iron Butterfly Payoff Diagram. The iron butterfly gets its name from the payoff diagram, which resembles the body and wings of a butterfly. The profit and loss areas are well defined with an iron butterfly. ... adjusting a short option results in the position being “inverted,” meaning the short call is below the short put. When inverted ...

How to Draw Long Call Payoff using Excel - YouTube About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators ...

Short Call - Overview, Profits, Advantages and Disadvantages A short call is an options strategy where an investor writes (sells) a call option on a stock because he expects that stock's price to decrease in the future. Understanding the Short Call Strategy. The short call strategy creates a contract between the option writer (seller) and the option buyer (holder).

Understanding Option Payoff Charts Feb 06, 2017 · Selling a Call Payoff. When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium.

Payoff Graphs vs Profit & Loss Diagrams - Overview, Examples Payoff graphs are the graphical representation of an options payoff. They are often also referred to as "risk graphs." The x-axis represents the call or put stock option's spot price , whereas the y-axis represents the profit/loss that one reaps from the stock options. The payoff graph looks like the graph outline shown below:

Synthetic Short Call Explained | Online Option Trading Guide Synthetic Short Call Payoff Diagram 0.00% Commissions Option Trading! Trade options FREE For 60 Days when you Open a New OptionsHouse Account Unlimited Risk The formula for calculating loss is given below: Maximum Loss = Unlimited Loss Occurs When Price of Underlying > Sale Price of Underlying + Premium Received

Writing Put Options | Payoff | Example | Strategies ... Writing Put Options Definition. Writing put options is making the ability to sell a stock, and trying to give this right, to someone else for a specific price; this is a right to sell the underlying but not an obligation to do so.. Explanation. By definition, Put options are a financial instrument that gives its holder (buyer) the right but not the obligation to sell the underlying asset at a ...

Call payoff diagram (video) - Khan Academy A call payoff diagram is a way of visualizing the value of a call option at expiration based on the value of the underlying stock. Learn how to create and interpret call payoff diagrams in this video. Created by Sal Khan. Google Classroom Facebook Twitter Email Sort by: Tips & Thanks Video transcript

Derivatives: Pay off Diagram "payoff diagram". A Payoff diagram is a graphical representation of the potential outcomes of a strategy. Results may be depicted at any point in time, although the graph usually depicts the results at expiration of the options involved

Solved The following diagram refers to what? Stock Net ... Profit Payoff and profit of Put option at expiration Payoff and profit of Call option at expiration Payoff and profit of Call option during the lifespan Payoff and profit of Put option during the lifespan Match the following columns. A $300. profit Short-term interest rates are 5%. An at-the-money six-month $95 call sells for $7.

Payoff and profit profile of a long call and short put ... Download scientific diagram | Payoff and profit profile of a long call and short put from publication: Valuing put options on single stock futures: Does the put-call parity relationship hold in ...

Put payoff diagram (video) - Khan Academy Put payoff diagram. Transcript. A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Learn how to create and interpret put payoff diagrams in this video. Created by Sal Khan.

Short put formula and payoff explained. Put option graph ... Short put: sellers of put options hope the stock price to go up or stay around current levels.If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike). A seller of a put option receives a premium, that is, the profit potential is limited and known in advance, while risks are conditionally unlimited.

Options Trading IQ Options Trading 101 - The Ultimate Beginners Guide To Options. Download The 12,000 Word Guide. Get It Now

Short call | Options Strategy, Payoff, Graph, Risk, Profit ... Short call is one of the option trading strategies which means selling or writing a call option.The strategy generates net credit in the beginning as the premium is received for writing a call. The trader has the obligation to buy the stock at the predetermined price at the time of options expiration.It is also known as naked or uncovered call as the trader does not own the underlying assets ...

Lecture 02: One Period Model - Princeton University Payoff/profit of a purchased call • Payoff = max [0, spot price at expiration –strike price] • Profit = Payoff –future value of option premium • Examples 2.5 & 2.6: S&R Index 6-month Call Option • Strike price = $1,000, Premium = $93.81, 6-month risk-free rate = 2% If …

Call Option Profit-Loss Diagrams - Fidelity Above 41.50, or to its right on the diagram, the long call earns a profit. Note that the diagram is drawn on a per-share basis and commissions are not included. Graphing a short call. Now for the third example—a short call. Graph 3 shows the profit and loss of selling a call with a strike price of 40 for $1.50 per share, or in Wall Street ...

Options Payoffs and Profits (Calculations ... - AnalystPrep The payoff for a call buyer at expiration date T is given by max(0,ST -X) m a x ( 0, S T - X) while the payoff for a call seller is −max(0,ST -X) − m a x ( 0, S T - X). Where: ST S T is the price of the underlying at expiration; and X is the exercise price.

Short Condor Explained | Online Option Trading Guide Max Profit Achieved When Price of Underlying = Strike Price of Lower Strike Short Call OR Price of Underlying >= Strike Price of Higher Strike Short Call. Short Condor Payoff Diagram. 0.00% Commissions Option Trading! Trade options FREE For 60 Days when you Open a New OptionsHouse Account.

![L2] Bull call spread payoff diagram : r/CFA](https://external-preview.redd.it/Mp1X4heoIT0S9FnK8ZJ9yC10ohP_c0G8L__LxnPfiMA.jpg?auto=webp&s=1cec23183b3c67947120f28fb9cca70556dca308)

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

0 Response to "38 short call payoff diagram"

Post a Comment